Ways to Save Money on a Tight Budget: Lessons from Living on $200 a Month for 5 Years

So what are the ways to save money on a tight budget? Managing your finances can be challenging, especially when you're on a tight budget. I've lived on $200 a month for 5 years straight, so I know a thing or two about pinching pennies. I can make two nickels dance, and I'll let you in on a little secret: one of the key ways is to avoid debt. Debt is generally bad and offers little benefit, with some exceptions like housing, which may make sense to finance. However, even then, I'd advocate having substantial cash or income before investing in property, especially if you lack experience.

You might wonder how I've managed to live so long on such a small amount. The key is focusing only on expenses that truly drive my business, such as essential utilities like phone and internet. These provide access to the global economy, which is crucial. I have mixed feelings about expenses like car insurance; while I don't feel I'm getting a return on it, I understand it's necessary to legally operate a vehicle.

One thing I've noticed over time is that people often buy things because they want them, not because they need them. I've carefully considered every dollar I've ever made, and I've learned to scale my efforts instead of spending time on low-value tasks. Unfortunately, many people don't see their time as valuable, which is why they take jobs instead of building their own dreams. When you work for yourself, you start to understand the true value of a dollar and see opportunity costs differently. One of the biggest lessons I've learned is distinguishing between what's truly essential and what's not. This perspective has been crucial in my journey of extreme budgeting and building a sustainable business.

Mastering Finances: How to Thrive on a $200 Monthly Budget and Build a Sustainable Business

I think it's important to cut expenses, but not for expense's sake. Sometimes it's worth the risk to take on more expenses if it'll grow your business. This is a delicate balance that we all have to learn as entrepreneurs. I get that it isn't always possible to avoid debt, but it should be a worthy goal to pursue. It really does nothing for us, and there are so many people perpetuating that saying it's not their money. But biblically speaking, if you're in debt, you're a slave to the lender. That's a fact, at least to me.

Believe me, I'm constantly having this debate with myself, but I would argue that the more I grow with my business, the more I see how important it is to learn how to increase our income. I rarely advocate for getting a job; if you know me, you know this to be true. I believe this economy would be much better if we all learned how to generate our own income and to be creative in our pursuits. I believe there's enough money to go around for all of us, and there is no shortage.

So how do you make the most of your $200 monthly budget? Well, the first thing is you need to get your housing right. I would certainly find a way to live rent-free. I had to live out of my car for a while; it was not fun, but it taught me a lot about where my money was going. As far as rent goes, it taught me to live in people's basements for $300 a month or less. Generally speaking, you get the idea - you need to keep your largest cost down, and that's your housing. That's the big one.

To avoid debt, it's best to learn how to increase your income. Often times we go into debt, or at least I did, because I didn't have enough income. Simple as it sounds, you need to learn how to increase your income. It's something I'm constantly learning myself, and to me, that starts with a business.

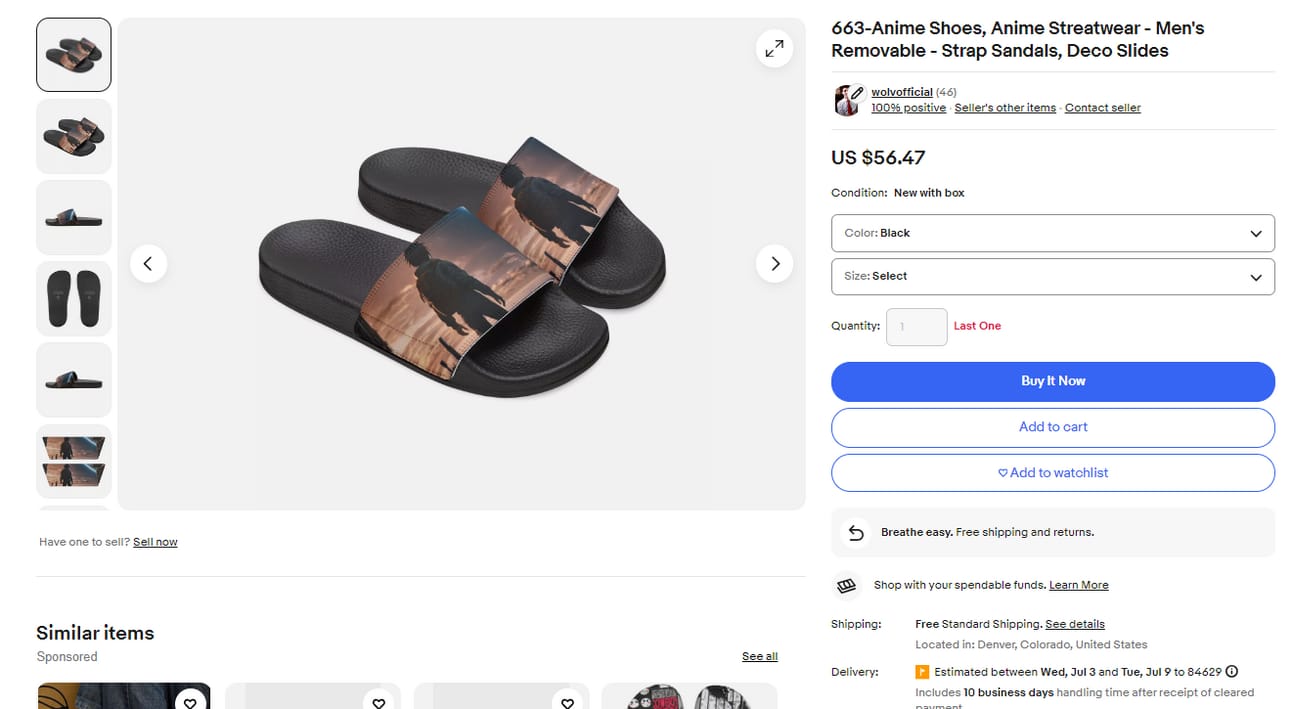

There are all sorts of different businesses. I've tried a lot of them, even Uber and Lyft. I've tried reselling shoes on Poshmark. There was a time when the most I made in a single year was $7,000. Some people laugh at that, but I laughed because it taught me a valuable lesson about my time and return on investment. It also taught me scalability and how important it is to do the work one time and get the residuals. There are different ways to scale your efforts to save money, and a lot of it comes down to time. Simply put, if we look at a dividend stock or just a growth stock in general, we see how when we go to bed at night, it continues to make us money theoretically. That is no different than scaling a business. It's just like that. Now it's up to you to be creative and come up with a business that is very similar if you don't want to do stocks, for example. A lot of business is being creative, and I don't want to dismiss other types of businesses because a lot of them make more money than I do. I'm only speaking from my experience.

Non-essential expenses include going to concerts, getting a Costco food membership, taking a cruise on a credit card, or overly spending on Christmas presents. Essential expenses are food, water, shelter. To build a sustainable business on a tight budget, you really have to get your systems in place. I always start and advocate for people to know their numbers. I like to refer to the Excel spreadsheet example. I'm a bit more advanced and have strong database skills, so I'm really able to get nitty-gritty with it, but you can do the same with Excel.

This is how you grow, and it does take time. But eventually, you get enough data to build a business, and it's exactly that. Business is starting with basic information which costs next to nothing. Excel is basically free, and then you can upgrade to a database later. This is how you start. It's not spoken about, but it is so true, and I'm so thankful later on that I've been able to understand this on a deeper level. I feel like it's a superpower that I've been able to attain over the years, and it took me 5 years to build my systems living on $200 a month.

I don't know if this is what it's going to look like for you, but for me, this is what I had to go through. And I wouldn't trade my data for the world. Because at any point in time, if I had to start over, I'd have my data. And if I didn't have my data, I would start ASAP. You can collect data on anything really, so give it a go. Start small. You'll be surprised at what you create.

Connect with Me

Stay updated with my latest projects and offers:

Sign up for my email list for exclusive updates.

Check out my main website for more information.

The History of Budgeting

Budgeting, as a concept, dates back to ancient civilizations. The early Egyptians and Greeks managed their finances meticulously, keeping records of trade and expenditures. Fast forward to the 20th century, the Great Depression of the 1930s forced many to adopt stringent budgeting practices. This period taught valuable lessons in frugality and financial planning.

In modern times, budgeting has evolved with technology. Today, apps and online tools help individuals track their spending and save money more efficiently. My favorite budgeting tool is Airtable, which you can try now by signing up here.

Maximizing Financial Control: How Airtable Streamlines My Expense Tracking

Airtable is a versatile platform that I use primarily for tracking expenses and managing my finances. While it's not a traditional budgeting tool, it helps me stay organized by allowing me to create a comprehensive list of upcoming expenses and monitor when they will leave my account. I appreciate the customization it offers, giving me control over my financial data.

Although I’ve tried other tools like Personal Capital and QuickBooks in the past, I prefer Airtable's simplicity for managing both my personal and business finances. Even though I don’t have many expenses due to my frugal lifestyle, I believe in maintaining a clear overview of all my income sources and expenses, especially as I plan to manage multiple businesses in the future.

Overall, Airtable has proven to be extremely helpful for my needs, especially when used alongside other apps like Qube Money.

Recommended Resources

For more helpful tips and resources, check out these recommended articles and products:

Christmas Gifts for Women – Find the perfect gift for the special women in your life.

Tablet Ordering System Restaurant – Learn about modern ordering systems for restaurants.

Buffalo Games Jigsaw Puzzle – Enjoy some quality time with these fun puzzles.

Airtable – Organize your life and business with this powerful tool.

Beehiiv – Sign up for Beehiiv to create and share your own articles.

However, finding effective ways to save money doesn't have to be overwhelming. Whether you're looking to stretch your dollars further each month or build a more sustainable financial plan, there are practical strategies you can adopt to make the most of what you have.

From cutting unnecessary expenses to finding creative ways to reduce daily costs, these tips will help you navigate your financial journey and achieve greater financial stability. Let's explore some of the best ways to save money on a tight budget and turn your financial challenges into opportunities for growth.

Effective Ways to Save Money

Track Your Spending: Keeping a detailed record of your expenses is crucial. Use tools like Airtable to organize and track your finances.

Cut Unnecessary Expenses: Identify and eliminate non-essential expenses. For example, cooking at home can save a lot compared to eating out. Check out my recommended reading for more tips.

Utilize Print-on-Demand: If you enjoy designing, platforms like Zazzle allow you to create and sell products without upfront costs.

Take Advantage of Affiliate Programs: Join affiliate programs to earn extra income. I recommend Beehiiv for its excellent commission rates.

Qube Money

Using the Qube Money app has truly revolutionized how I manage my finances on a tight budget. This innovative app combines digital banking with a budgeting system that helps me stay on top of my spending and savings goals seamlessly. With Qube Money, each dollar I earn is allocated to specific “qubes” or categories, such as groceries, entertainment, and savings, before I spend it.

This approach has given me unparalleled control and clarity over my finances.

One of the standout features of Qube Money is its proactive budgeting system. Instead of looking back at where my money went, Qube allows me to decide where it will go ahead of time. By pre-planning my spending, I’ve been able to avoid unnecessary purchases and ensure that my spending aligns with my financial goals.

This method has not only helped me save more effectively but also reduced the stress and anxiety associated with managing a tight budget.

Additionally, the app’s user-friendly interface makes it easy to monitor my financial status at a glance. I can quickly see how much money I have left in each qube and make adjustments as needed. This real-time tracking and the ability to visually see my budget has made sticking to it much easier and more intuitive.

Since adopting Qube Money, I've experienced a significant positive change in my financial habits.

I'm saving more consistently and making more mindful spending decisions. The app has empowered me to take control of my finances, making it possible to turn my financial challenges into opportunities for growth and stability.

If you’re looking for a practical and effective way to manage your finances, especially on a tight budget, I highly recommend giving Qube Money a try. It’s been a life-changing tool for me, and it could be for you too.

If you're interested in learning more about budgeting, print-on-demand, music production, or just want to follow my journey, here are some links where you can connect with me:

Main Website: WolvOfficial

Music: Listen and lease my instrumental beats on Airbit and Spotify. You can also find my music on SoundCloud and iTunes.

Books and Articles: Read my latest book on Amazon Kindle Direct and explore my articles on Beehiiv.

The Future of these sorts of apps

The future of digital envelope banking apps, like Qube Money, looks very promising as they continue to revolutionize personal finance management.

These apps take the concept of the traditional envelope budgeting method and enhance it with digital capabilities, making it easier for users to allocate and control their spending across different categories. Here’s how these apps are shaping up to change the financial landscape:

Key Innovations and Future Trends:

1. Advanced Budgeting Automation:

Apps similar to Qube Money are expected to increasingly leverage AI to automate and optimize budget allocations. These apps can predict spending needs based on historical data and make proactive suggestions to ensure users stay within their financial goals.

2. Seamless Integrations:

Future versions of these apps will likely offer deeper integrations with other financial services and platforms. This could include partnerships with investment apps, lending services, and insurance providers, providing a more comprehensive financial management solution.

3. Real-Time Financial Insights:

Users will benefit from more real-time data and insights. These apps will provide instant notifications and adjustments to budgets as transactions occur, helping users maintain control over their finances moment-by-moment.

4. Enhanced Security Features:

As security remains a top concern, these apps will integrate more advanced security measures, such as biometric authentication, multi-factor verification, and end-to-end encryption to protect users' data and provide peace of mind.

5. User-Centric Design and Customization:

The focus will be on making these apps even more user-friendly and customizable. Users will be able to tailor their budgeting experience to their unique needs, with features like personalized dashboards, customizable alerts, and tailored financial advice.

6. Community and Social Features:

Many of these apps are beginning to incorporate social features, allowing users to share budgeting tips, participate in community challenges, and even support each other’s financial goals through social saving groups.

Notable Apps Similar to Qube Money:

- Goodbudget: This app is based on the envelope budgeting system and allows users to allocate their income into digital envelopes for different spending categories. It’s particularly known for its user-friendly interface and straightforward approach to budgeting.

- YNAB (You Need A Budget): YNAB emphasizes teaching users to allocate their income to specific categories and prepare for future expenses. It offers robust features for tracking spending, planning budgets, and achieving financial goals.

- Simple: Although it has been integrated into BBVA, Simple was known for its envelope-based budgeting feature, which allowed users to allocate funds into various goals and track their spending effortlessly.

- Mvelopes: This app directly mirrors the traditional envelope budgeting system, allowing users to create and manage digital envelopes for different spending needs. It also provides tools for debt reduction and financial planning.

- Envelope: This app focuses on helping users budget their daily expenses by creating virtual envelopes that represent different spending categories. It simplifies tracking and managing money in a straightforward manner.

Gif by unpopularcartoonist on Giphy

As these digital envelope banking apps evolve, they promise to provide even more innovative and user-friendly solutions for personal financial management.

By offering real-time insights, advanced automation, and seamless integration with other financial tools, they are set to make budgeting and saving easier and more effective for everyone.

The future of managing money on a tight budget is bright, and these apps will continue to lead the way in helping people achieve financial freedom.

Guide to Saving Money on a Tight Budget

A Historical Perspective on Budgeting

Saving money has been a critical part of human history. From the ancient barter systems to the sophisticated digital financial tools we have today, the methods of managing and saving money have evolved significantly.

Historically, people relied on physical forms of currency and goods, using systems like bartering to manage resources. As civilizations progressed, the introduction of coins, paper money, and eventually digital currency reshaped how people save and manage their finances.

During the Great Depression, frugality and saving became essential survival skills. Families would repurpose items, grow their own food, and find creative ways to stretch their dollars. This period cemented the importance of saving money, even in the face of economic hardship.

In modern times, with the advent of digital banking and financial technology, saving money has become more accessible and efficient. Apps like Qube Money and other digital envelope systems have revolutionized how people budget, allowing them to allocate funds into virtual envelopes for different expenses. These tools have made it easier than ever to manage finances on a tight budget.

## Modern Strategies to Save Money on a Tight Budget

In today’s fast-paced world, managing finances can be challenging, especially when living on a tight budget. However, there are numerous strategies and tools that can help you save money effectively.

Embrace Digital Envelope Banking

One of the most effective methods for managing a tight budget is using digital envelope banking apps like Qube Money. These apps allow you to allocate your income into different virtual envelopes designated for specific expenses.

This method not only helps in controlling spending but also ensures that you stick to your budget for each category.

Discover the power of digital budgeting with tools like Qube Money by visiting their main website. For those interested in exploring more about envelope banking, check out this recommended reading on modern budgeting systems.

Utilize Print-On-Demand Services

Another innovative way to save and make money is through print-on-demand services. Platforms like Zazzle allow you to create and sell custom-designed products without the need for upfront inventory. This business model can be particularly beneficial if you have creative skills and want to monetize them with minimal investment.

Browse a vast collection of print-on-demand products at my Zazzle store, where you can find unique designs and support small businesses.

Explore Affiliate Marketing and Side Hustles

Affiliate marketing and side hustles are excellent ways to supplement your income. For example, by becoming an affiliate for companies like Buffalo Games or Beehiiv, you can earn commissions by promoting their products or services. Additionally, selling second-hand items on platforms like Poshmark can be a lucrative side hustle.

Sign up for Poshmark and start selling secondhand goods by following this link.

My Ventures

Beyond writing articles, I sell print-on-demand products and produce music. You can explore my work on various platforms:

Recommended Articles and Books

If you enjoy reading, check out my blog on Beehiiv here and explore my recommended reading:

Christmas Gifts for Women: Dive deeper into this topic by reading this article.

Goals by Brian Tracy: A highly recommended book that you can find here.

Saving money on a tight budget can be challenging, but with the right strategies and tools, you can make it work. One effective method is utilizing free blogging platforms. Writing a blog can not only be a cost-free hobby but also an income-generating activity if done correctly. To get started with your blog and potentially earn some extra cash, check out the best free blogging platforms. Start your blogging journey today and see how it can boost your savings!

Additionally, managing your finances effectively can significantly contribute to your savings. Implementing a CRM and email marketing software can streamline your business processes and save you money in the long run. Discover the best tools to streamline your finances by reading this article. Don't miss out on these valuable insights that can help you cut costs and maximize your budget!

Lastly, making money from home is a great way to supplement your income and ease financial stress. There are numerous opportunities to explore, and this guide provides detailed information on various methods to make money from home online. Learn how to make money from home with practical tips and strategies. Explore these opportunities now and take control of your financial future!

By exploring these recommended readings, you can discover practical tips and tools to manage your finances better and find new ways to save money on a tight budget. Dive into these resources today and start your journey towards financial freedom!

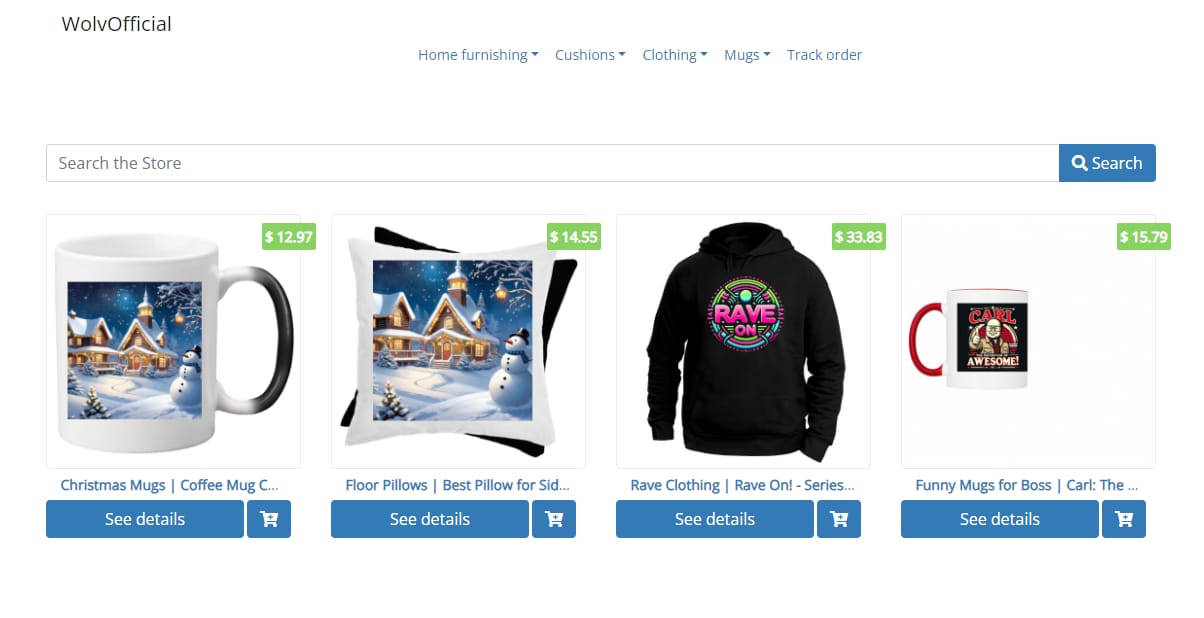

Hoplix

I have a store on Hoplix that receives a lot of attention, and I'm still figuring out why it is so popular. Hoplix is a print-on-demand platform that allows creators to design and sell custom products without needing to hold inventory. People seem to really like my store, even though the inventory is currently limited. The store is sometimes displayed in a different language, which adds to the unique experience. You can check out my products and explore the store here.

On my Hoplix store, I offer a variety of unique, custom-designed products that appeal to a wide audience. Although the selection is currently limited, I am planning to add more items on a regular basis. Hoplix handles all the printing, shipping, and customer service, ensuring a seamless shopping experience. I would love to hear about your experience if you decide to order something, as your feedback will help me improve the store and better meet your needs. Thank you for your support and interest!

Leveraging Financial Tools and Apps

Gif by AmazonFreevee on Giphy

Financial apps like QUBE provide comprehensive solutions for managing your finances and organizing your budget. By integrating these tools into your daily routine, you can streamline your financial planning and keep track of your spending effectively.

Connect with WolvOfficial

As you explore these strategies, I invite you to connect with me and my brand, WolvOfficial. I’m passionate about helping others manage their finances, and I offer a variety of products and resources to support your journey.

Explore My Content and Products

- Music and Beats: Listen to and lease my instrumental beats on Airbit and Spotify. You can also find my music on SoundCloud and iTunes.

- Books and Articles: I write extensively on personal finance and offer various books. Check out my latest book on Amazon, What Career is Right for Me?. For more insights, read my articles on Beehiiv.

- Online Stores: Shop my curated collections of clothing and home decor on eBay and Poshmark. Also, explore a wide range of downloadable content on Gumroad and Payhip.

Join My Community

Stay connected and get the latest updates by signing up for my email list here. You can also follow me on social media:

Instagram: Follow me on Instagram for behind-the-scenes content and updates.

Twitter: Join me on Twitter for the latest news and thoughts.

YouTube: Subscribe to my YouTube channel for videos and tutorials.

Recommended Reads and Tools

For more in-depth advice and recommendations, check out these resources:

Recommended Book: If you're looking for a motivational read, I highly recommend Goals by Brian Tracy.

Email Marketing: For effective email marketing solutions, consider Aweber, a trusted platform for years.

Navigating a tight budget doesn't have to be a daunting task. With the right tools and strategies, you can effectively manage your finances and even find opportunities to grow your income. From embracing digital envelope banking to exploring print-on-demand services and leveraging affiliate marketing, there are countless ways to save money and improve your financial health.

For more personalized advice and to explore a wide range of resources, connect with me through my main website and follow my journey on social media. Together, we can achieve financial stability and success.

- #BudgetingTips

- #FinancialFreedom

- #SaveMoney

- #DigitalBanking

- #WolvOfficial

Disclaimer: This article contains affiliate links. If you make a purchase through these links, I may earn a commission at no additional cost to you.

For additional insights and to explore more of my work, visit my blog on Beehiiv and check out my latest projects on Airbit and Payhip.